You’ll be dealing a lot with these costs throughout your time as a consultant. outsourcing, replacing parts, optimizing processes) is much easier than cutting fixed costs. And as we’ve already established, cutting variable costs (i.e. Why? Because your job is to identify revenue or savings that will drop to the bottom line. Why is variable cost important to understand for prospective consultants? As a consultant, you’ll be spending most of your time dealing with a company’s P&L (or the income statement). Variable Costs Specific To The Consulting Industry If 10 cars are assembled, the cost would be $2,000. If 100 cars are produced, the tire costs would be $20,000. Because the manufacturer only pays this cost for each unit produced, this is a variable cost. If the tires cost $50 each, the tire costs for each manufactured car are $200. For example, every car that is produced must have a set of four tires. Each component of a car is a variable cost, including the tires.

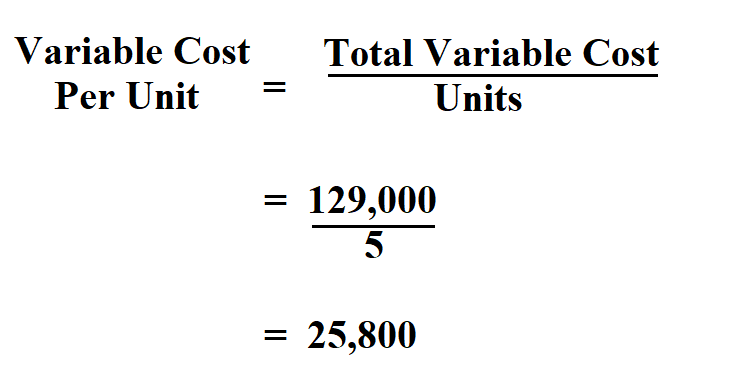

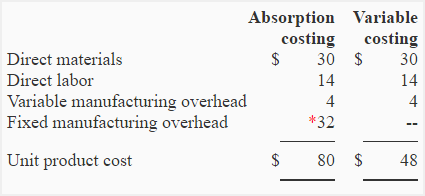

Variable costs are typically much easier to modify than fixed costs, which makes it very important for business leaders to pay attention to them on a regular basis. Taken together, these are commonly referred to as the Cost of Goods Sold, or COGS. Variable cost examples include direct labor, energy and raw materials costs. If the price they receive for the product is higher than the AVC, it is one indicator of a profitable product. Profit-maximizing manufacturing companies use the AVC to help them decide at which time they should end the production for a specific good. If you divide the total variable cost by the total output produced, then you receive the average variable cost (AVC). The average variable cost can be considered as the total variable cost per unit of output. Be careful that you don’t mix up variable cost with variable costing, which is an accounting method used to report variable cost. The total variable cost formula can then be described as the total quantity of output times the variable cost per unit of output.

To calculate the total variable costs for a business you have to take into account all the labor and materials needed to produce one unit of a product or service. Overall, variable costs are directly incurred from each unit of production, while fixed costs rise in a step function and are not based on each individual unit. It is in fact, a primarily variable-cost-based business, which has huge ramifications for how it can and should operate. It’s amazing how Uber has been able to convince Wall Street that it is primarily a fixed cost tech platform. This is a variable cost, and is Uber’s primary expense.

Variable cost per unit calculator online driver#

For example, Uber pays a driver for every ride they complete. If the company produces more, the cost increases proportionally. So, by definition, they change according to the number of goods or services a business produces. Variable costs are the costs incurred to create or deliver each unit of output.

0 kommentar(er)

0 kommentar(er)